Find your property

Sell your property

Secure your transactions

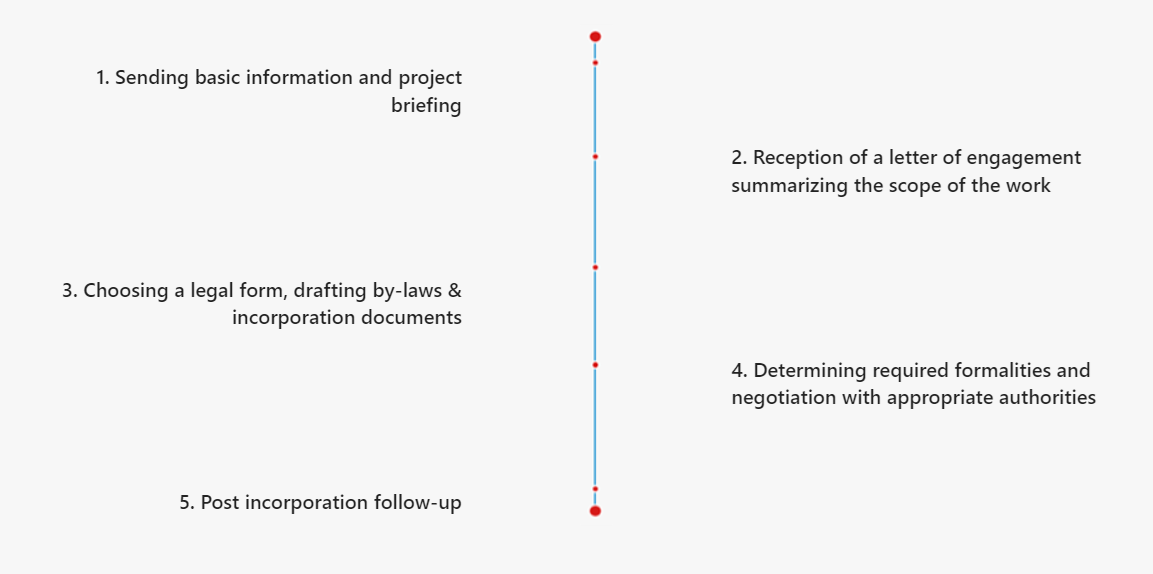

Business Formation and M&A

Tax Advisory

Comply with the legislation

Need to invest in France? The invest guide section provides information about investment in France.

Why should you invest in France? France represents a strategic market within the European Union.

When a company decides to invest in France, it shall carefully review the legal & tax regulations. Enter France investment guide will help you understanding the main issues and legal aspects. It shall not replace the advice that should be given by local French lawyers or accountants. Business advice is usually provided by consultants such as accountants called experts comptables or strategists whereas lawyers will cover business law and tax law.

Why invest in France ?

France is becoming more and more attractive to foreign investors, especially when it comes to investing in industrial projects.

Incentive programs

France grants a R&D tax credit to companies carrying R&D activities in France.

They allow companies to significantly decrease their taxable basis as well as the burden of social security contributions.

They allow companies to significantly decrease their taxable basis as well as the burden of social security contributions.

The French tax system

Moreover, French tax revenue authority generally pays special attention to international transactions, which are often regarded as potential sources of tax evasion.

The french legal framework

This entry will give you a quick overview of the French legal framework and can be of help if you go through it.

DOING BUSINESS IN FRANCE

Is France made for you ?

Enter France has the objective to promote France and its economy by attracting foreign investors in France.

Investors probably have lots of questions that are difficult to resolve from abroad.